Contents:

No matter your experience level, download our free trading guides and develop your skills. While not conventional, they can also be used to signal entries — in conjunction with a trend filter. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading office with us.

- The general principle is that by comparing a stock's position relative to the bands, a trader may be able to determine if a stock's price is relatively low or relatively high.

- It’s subjective and best used with other indicators and a well-crafted trading plan.

- Flexible and visually intuitive to many traders, Bollinger Bands® can be a helpful technical analysis tool.

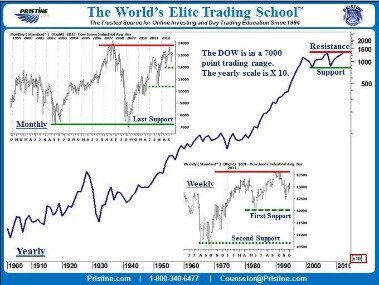

- \nThe average trading range is one of the best tools you have for keeping your sanity and perspective.

For example, if the https://trading-market.org/ declines during a bullish flag, it is a sign that the price is about to have a bullish breakout, and vice versa. When the market is consolidating, the ATR usually shows no major moves. If the price breaks out and starts moving lower, you can use the ATR to validate whether there is enthusiasm in the market about it. The ATR is an indicator that is significantly different from other indicators we have covered. This is because it is not used entirely to predict where the asset is moving. It is also not used to show whether an asset is overbought or oversold.

Average True Range (ATR) Formula, What It Means, and How to Use It

The stop loss moves up as the price moves up letting you know where your stop loss level is. An IR% of 5% means a $100 stock tends to move $5 on average, a $1000 stock will move $50, or a $10 stock will move $0.50 per price bar, on average. If you notice on this chart, ADR is not affected by the gap higher in February.

It does not indicate price direction, but instead tracks how much an asset moves in a given time period. Welles Wilder, the Average True Range is an indicator that measures volatility. As with most of his indicators, Wilder designed ATR with commodities and daily prices in mind. They were are often subject to gaps and limit moves, which occur when a commodity opens up or down its maximum allowed move for the session. A volatility formula based only on the high-low range would fail to capture volatility from gap or limit moves.

Using the ATR for Futures vs. Stocks

Measuring market volatility can help in identifying buy and sell signals and, additionally, risk potential. True Range takes into account the most current period high/low range as well as the previous period close . The indicator can help day traders confirm when they might want to initiate a trade, and it can be used to determine the placement of a stop-loss order. The time period used for ATR is often 14 days, though shorter periods can be used, too.

The key, of course, is making sure your multiplier for the target price is greater than the stop loss, so over a series of trades, you have a greater likelihood of turning a profit. Alternatively, you could be more conservative and trade stocks with a volatility ratio of .0025 – .0050 on a 5-minute scale. Early on in my trading career, I would have the standard rule of I only want to use “x” amount of dollars or risk “x” amount of dollars per trade. The challenge I would face after entering the position is that the stock would move wildly in one direction or another in ways that I either did not anticipate or were not accustomed. While the ATR isn’t necessarily the most sophisticated approach to technical analysis, it can keep you out of serious trouble. If you have missed a market move, you know it is very unlikely that entering a new trade would make sense.

Unusual Call Option Trade in Boston Scientific (BSX) Worth $238.50K – Nasdaq

Unusual Call Option Trade in Boston Scientific (BSX) Worth $238.50K.

Posted: Mon, 17 Apr 2023 21:36:00 GMT [source]

In other words, the stop loss has been placed below two or three days of typical movement. In the settings for the indicator, there is the option to covert the range to dollars ($) instead of a percent (%). All charts are provided by TradingView, the charts I personally use. Overall, the ATR may be a great addition to a wide variety of trading strategies and prove effective in enhancing price analysis. And when the ATR and the EMA were on top of each other, clustering together, the price was in a narrow sideways period.

Bollinger Bands: What They Are and How to Use Them

You may have noticed that markets move differently and some markets tend to trend significantly more and longer than others. A look at the daily pip variation in the table below shows that there can be significant differences between different Forex pairs. During the second highlighted phase, the price was in a downtrend. The STOCHASTIC confirmed the strong bearish trend strength and it dropped below the 20 line.

It simply refers to the degree of stock average true range of financial assets within a certain period of time. For example, assets like Bitcoin and Ether are more volatile because their prices can rise and drop by more than 5% within a session. On the other hand, some stocks like Berkshire Hathaway are not volatile since they don’t move significantly in a session. Most technical indicators are based either on an instrument’s actual price and its behavior or trading volume. The Average True Range or ATR is a volatility-based indicator that compares the current price to the entire range for a particular period.

For newbie traders, this explanation will get a bit muddy, but do the best you can to stay with me. The key to making money is buying a stock for less than what you sell it for. The ATR should not be used to identify stop loss and exit targets as past volatility is not a predictor of future activity. Notice that the 20-day EMA has been sloping lower for several months.

How Much Will it Move? Learn to Use Average True Range on TradeStation’s Award-Winning Platform

This indicator was originally developed by the famed commodity trader, developer and analyst, Welles Wilder, and it was introduced in 1978. Wilder is the founder of several highly important technical indicators, now regarded as the core technical analysis tools in trading. Besides the Average True Range indicator, he also invented the Relative Strength Index , the Average Directional Index and the Parabolic SAR. Commodity and historical index data provided by Pinnacle Data Corporation. Unless otherwise indicated, all data is delayed by 15 minutes.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. The ATR will appear at the bottom of the chart as a single line. There’s not a trader around who trades with 100% accuracy.

Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. Again, the ATR is not a standalone indicator for determining stop loss or profit targets when trading. However, one cannot deny the power of combining the ATR with price action to identify a likely change in trend. When attempting to identify a great entry point, a key indicator that a stock is likely in the process of going counter to the primary trend is a drop off in volatility. In theory, this equates to diminishing price movement, which implies that either the buying or the selling interest is tapering. The key thing to remember when determining which volatility ratio works best for your trading style is to stick to one-time frame.

See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. As you can see, the indicator showed little movements when the index was in consolidating. It started moving higher when the index started to decline. This is an indication that there was enthusiasm about the new downward trend. A good example is what happened during the coronavirus pandemic in 2020. Since there was a lot of volatility, many investment banks and hedge funds that have large trading accounts generated billions of dollars.

Understand that this indicator is another tool to aid your trading. You need to have a sound trading plan and strategy in place above all else. The rest is there to help you spot opportunity and confirm what you already researched. The ATR won’t show you if a stock’s trending the direction you want to trade. You can hold a swing trade for a few days, weeks, or maybe even months.

The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. This scenario may be a reliable indicator of decreasing momentum. Apple managed to muster up one last push higher before the stock had a swift sell-off taking the stock back to the starting point of the preceding rally. The most common way is to pay attention to how big a move the market could potentially make during a given trading session.

“Made Available to Trade” Determination for Certain Overnight Index … – Sidley Austin LLP

“Made Available to Trade” Determination for Certain Overnight Index ….

Posted: Mon, 17 Apr 2023 14:22:26 GMT [source]

Because there must be a beginning, the first TR value is simply the High minus the Low, and the first 14-day ATR is the average of the daily TR values for the last 14 days. After that, Wilder sought to smooth the data by incorporating the previous period's ATR value. The average true range values are useful for entry and exit triggers. However, they should not depend only on the average true range, rather it should be used along with a strategy to determine suitable trades.

A trader using an ATR indicator strategy might place a stop order $4 below the entry point. If the initial trade is profitable, and as the ATR changes, the trader might adjust the stop order such that it’s always 2x the ATR. Average True Range , Average Day Range , and Intraday Range are all measures of how much an asset moves. They use different formulas, and therefore one may be better suited to a particular style of trading than another. Therefore, understanding changes in ATR structure may be beneficial for traders to correctly identify changes in price and trend structure. The ATR can be a great confluence for trend-following traders in such a case.

The indicator does not provide an indication of price trend, simply the degree of price volatility.The average true range is an N-period smoothed moving average of the true range values. The calculation of the average true range is 14-period based. For example, a new average true range is calculated every day on a daily chart and every minute on a one-minute chart. When plotted, the readings form a continuous line that shows the change in volatility over time.

The first True Range value is simply the current High minus the current Low and the first ATR is an average of the first 14 True Range values. Even so, the remnants of these first two calculations “linger” to slightly affect subsequent ATR values. Spreadsheet values for a small subset of data may not match exactly with what is seen on the price chart. On our charts, we calculate back at least 250 periods , to ensure a much greater degree of accuracy for our ATR values. Typically, the Average True Range is based on 14 periods and can be calculated on an intraday, daily, weekly or monthly basis.

Listed as “Average True Range,” ATR is on the Indicators drop-down menu. The “parameters” box to the right of the indicator contains the default value, 14, for the number of periods used to smooth the data. To adjust the period setting, highlight the default value and enter a new setting. SharpCharts also allows users to position the indicator above, below or behind the price plot. A moving average can be added to identify upturns or downturns in ATR.