With 90-day terms, you can expect construction companies to have lower ratio numbers. If you’re in construction, you’ll want to research your industry’s average receivables turnover ratio and compare your company’s ratio based on those averages. Calculating AR turnover is a valuable tool for businesses to assess their credit and collection processes. By understanding the importance of AR turnover and implementing strategies to improve it, companies can enhance their cash flow, financial stability, and overall financial performance. An efficient company has a higher accounts receivable turnover ratio while an inefficient company has a lower ratio.

Current Assets Movement or Activity Ratios

You still get your product, but the payment is deferred – meaning it is put off to a later time. As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment. Such a formula has several uses in the business for managerial decisions as well as the various stakeholders who have some interest in the business in the form of lending or investment in the form of capital.

Receivable Turnover Ratio FAQs

Be sure to compare with your nearest similar competitors, and not businesses that are significantly bigger or smaller than yours. The above two alternative conclusions are contradictory of each other therefore the ratio should be interpreted with caution. The turnover ratios formula indicates how efficiently the assets and liabilities are managed in a particular period.

Important Accounting Ratios and Formulas

- As we previously noted, average accounts receivable is equal to the first plus the last month (or quarter) of the time period you’re focused on, divided by 2.

- This is usually calculated as the average between a company's starting accounts receivable balance and ending accounts receivable balance.

- The company may then take the average of these balances; however, it must be mindful of how day-to-day entries may change the average.

- The most common liquidity ratios are the current ratio and the quick ratio.

- To stay on top of profitability, they will assess ways to improve efficiency, reduce costs, incentivize employees and optimize operations to maximize the bottom line.

With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business. Even if you trust the businesses that you extend credit to, there are other reasons you may want to make a more serious effort to develop a higher ratio. Our team is ready to learn about your business and guide you to the right solution.

how to calculate car depreciation

If you have some efficient clients who are always on time with their payments, reward them by offering some discounts which will help attract more business without affecting your receivable turnover ratio. Norms that exist for receivables turnover ratios are industry-based, and any business you want to compare should have a similar structure to your own. The receivables turnover ratio shows us that Alpha Lumber collected its receivables 11.43 times during 2021. In other words, Alpha Lumber converted its receivables (invoices for credit purchases) to cash 11.43 times during 2021. Since we already have our net credit sales ($400,000), we can skip straight to the second step—identifying the average accounts receivable. Now that you understand what an accounts receivable turnover ratio is and how to calculate it, let’s take a look at an example.

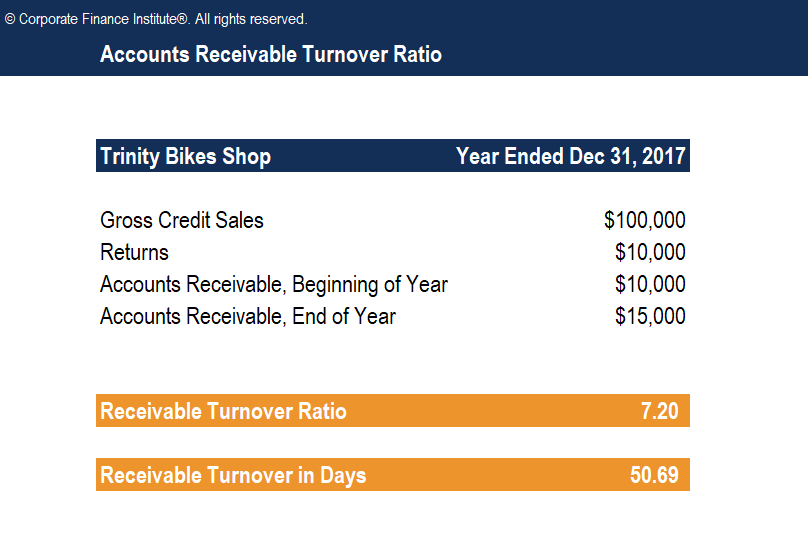

If a company loses clients or suffers slow growth, it may be better off loosening its credit policy to improve sales, even though it might lead to a lower accounts receivable turnover ratio. Companies with more complex accounting information systems may be able to easily extract its average accounts receivable balance at the end of each day. The company may then take the average of these balances; however, it must be mindful of how day-to-day entries may change the average. Similar to calculating net credit sales, the average accounts receivable balance should only cover a very specific time period. To compute receivable turnover ratio, net credit sales is divided by the average accounts receivable.

A company could improve its turnover ratio by making changes to its collection process. Companies need to know their receivables turnover since it is directly tied to how much cash they have available to pay their short-term liabilities. The accounts payable turnover ratio measures the speed with which a company pays off its suppliers. Thus, any type of turnover ratio formula accounting measures how well and how fast the company is able to convert its resources into useful products and sell them in the market to earn revenue.

A high ratio means a company is doing better job at converting credit sales to cash. However, it is important to understand that factors influencing the ratio such as inconsistent accounts receivable balances may inadvertently impact the calculation of the ratio. Accounts receivable turnover ratio calculations will widely vary from industry to industry. Once you have these two values, you’ll be able to use the accounts receivable turnover ratio formula. You’ll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio, or rate.

You can find the numbers you need to plug into the formula on your annual income statement or balance sheet. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Someone on our how much can you contribute to a traditional ira for 2019 team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Accounts receivable turnover ratio is calculated by dividing your net credit sales by your average accounts receivable. The ratio is used to measure how effective a company is at extending credits and collecting debts. Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers. Like other financial ratios, the accounts receivable turnover ratio is most useful when compared across time periods or different companies. For example, a company may compare the receivables turnover ratios of companies that operate within the same industry.

The turnover ratio is a measure that not only shows a company's efficiency in providing credit, but also its success at collecting debt. This article will explain to you the receivables turnover ratio definition and how to calculate receivables turnover ratio using the accounts receivable turnover ratio formula. Additionally, you will learn what does a high or low turnover ratio mean, and what are the consequences of each. The receivable turnover ratio is used to measure the financial performance and efficiency of accounts receivables management. This metric helps companies assess their credit policy as well as its process for collecting debts from customers. At the end of the day, even if calculating and understanding your accounts receivable turnover ratio may seem difficult at first, in reality, it’s a rather simple (and certainly important) accounting measurement.