What is FastWin App?

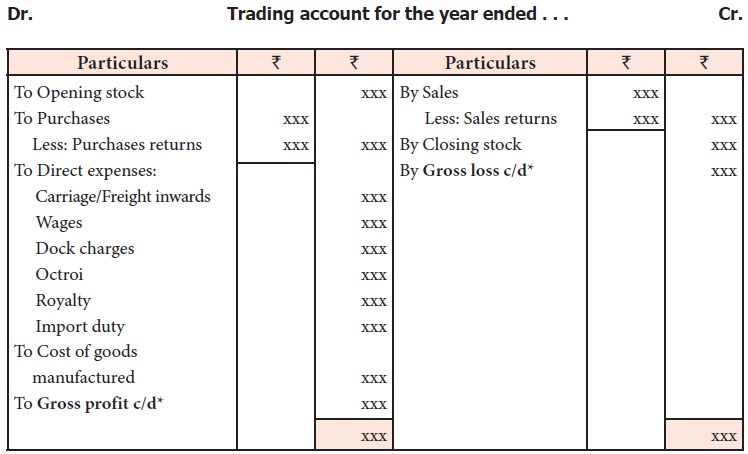

The falling wedge chart pattern usually can be seen in the downtrend. It offers many different trading options, such as commodities, equity, futures, etc. The only catch is that it doesn't allow for DIY stock trading; it primarily uses ETFs. Another important concept is the risk reward ratio. 0 people liked this article. Nial Fuller is a professional trader, author and coach who is considered 'The Authority' on Price Action Trading. Buying to hold/investment and trading to make profit to be used to buy more investment. For every business, it's important to clearly understand sales and expenses. This article covers what financial trading is and how it works, step by step. These can significantly boost your initial earnings. Bajaj Financial Securities Limited "Bajaj Broking" or "Research Entity" is regulated by the Securities and Exchange Board of India "SEBI" and is licensed to carry on the business of broking, depository services and related activities. Every time you lose money, it's like a loss of future earnings potential, and that's why it's absolutely vital to keep from losing money. Read our full length review of FOREX. Additionally, many brokerage firms provide advice regarding most profitable investable securities in the market, acting as a stable investment option for novice investors. Studies also show that day traders' earnings are marked by extreme variability. Dropshipping refers to the practice of selling tangible goods online. Multiple monitors allow you to display various charts, watchlists, and news feeds simultaneously — which you should do because day trading is all about processing information quickly and putting it to use. Leave your genuine opinion and help thousands of people to choose the best crypto exchange. It is not intended, and should not be construed, as a specific recommendation, individualized tax, legal, or investment advice. For example, in the previous case, if the index value is lower than the strike price spot price < strike price, the option is said to be OTM. The following day google is mostly flat and micron has a significant gap down from where I bought in. Scalping is the shortest time frame in trading and it exploits small changes in currency prices. Coffee prices are erratic, and supply fluctuations are simple effects of the weather. Chart patterns can be identified on our chart pattern screener tool. Using an investment app can be a great way to manage your investments and keep track of your portfolio. The best time frame for intraday trading varies; common choices include 1 minute, 5 minute, and 15 minute charts, depending on the trader's strategy. D at 3% on Sundry Debtors.

What’s on this page?

In order to participate in the stock market you need to have a trading account. This strategy is an alternative to buying a long put. Stock's zero brokerage proposition is really unique. Our Discord:FavAVQpm. Has sold 758 shares of India Cements in JLB01. 24/7 dedicated support www.pocketoptiono.website and easy to sign up. However, you need to have the right mindset. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long short arbitrage position.

DISCLOSURES UNDER THE PROVISIONS OF SEBI RESEARCH ANALYSTS REGULATIONS 2014 REGULATIONS

Yes, your online broker is safe from collapse. Real time data, for instance, instantaneously displays the price variation of a specific stock, assisting traders in making profitable trades. Households and businesses both seek advice from independent experts. Now, if the shares are already there in your demat account, you don't need to worry because you can transfer your account to another broker there's a separate procedure for this that takes some time with your holdings intact. It offers a simple and intuitive interface, convenient trade management, and FREE leverage. This strategy is strategically employed to harness opportunities in a market environment characterized by stability. They are also selective about which ones they talk about too. Learning about investing is a pleasant experience, thanks to excellent organization, quality and in house curated content. SaxoTraderGO delivers rich charting capabilities and – touching on a theme here – closely matches the experience of the platform's web based charts. Boost your demo experience with free eResources and follow our Social pages for upcoming events. There may be times when you are unsure about the direction in which the price will move, but you expect a significant shift in price. When you're ready to begin options trading, start small—you can always try more aggressive options strategies down the road. Check out NerdWallet's guide to getting started with options trading. Store and/or access information on a device. Find the perfect in person Investing class near you by searching for your address, city, or zip code. As a result, trading can take place without a middleman. Mutual funds disclaimer: Mutual Fund investment are subject to market risk. There is plenty of liquidity at Deribit, too – so you should never have any issues entering and exiting the market. It's these changes in the exchange rates that allow you to make money in the foreign exchange market. I've written a guide that details the differences between these two trading platforms: check out my MT4 vs MT5 guide. Numerous trading platforms offer free tutorials, as well as webinars and seminars that explore how to trade the financial markets.

We and our partners process data to provide:

The cyclical variations should be carefully observed by analysing 52 week high and low values, as it gives a precise idea about whether an individual should assume long or short positions while investing. Fidelity is one of the largest and one of the most well rounded brokerages available in the US today. However, you place a stop loss at Rs. 70% of retail client accounts lose money when trading CFDs, with this investment provider. I recommend this book because it's a case study into why we need to keep our trading psychology in check. Day trading is capitalizing on price movements in the market during the same day. For beginners in 2024, the best stock trading apps are Fidelity and Charles Schwab. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. Long and Short Iron Condor. As you can see, it is sometimes difficult to judge such a tight pattern. Correct and Rewrite the following statement. Analyzing Stock Volatility. They can use the buy first and sell later approach or go for a sell first and buy later strategy. In March 2000, this bubble burst, and many less experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy. Good thing that it was only a minor issue i was contacting about, so no rush. MiFID enabled trading venues to compete with one another. Its menu is customizable.

Investment vehicles

But that's life in the big city. This strategy profits if the underlying stock is at the body of the butterfly at expiration. True consistency in trading does not merely reflect a series of wins; it is a manifestation of deeply ingrained habits that align with disciplined risk management. Dedicated bots assigned to your strategy for ultra fast continuous condition checking and execution. The flagship desktop app provides a high caliber experience, with built in charting indicators, more than 180 technical and fundamental indicators, the ability to create your own indicators and decades of historical data for backtesting strategies. The trader's competence and the market conditions, however, are significant factors in determining success. This inconvenience forged the way for money, which acted as a standard against which the values of all products are measured. Outside of regular trading hours, news events or market developments can lead to significant price gaps or shifts when the market reopens. The actual market price of the option may vary depending on a number of factors, such as a significant option holder needing to sell the option due to the expiration date approaching and not having the financial resources to exercise the option, or a buyer in the market trying to amass a large option holding. Although you could invest $1 in fractional shares of a specific stock, the better approach with limited capital is to use ETFs. 00 for joint accounts.

Gold Trading Strategy for Beginners: Essential Steps to Master the Market

For example, if you're looking to trade cryptocurrencies against the US dollar, you need to ensure your chosen app supports fiat to crypto pairs. 25, you'd incur a loss. GME's soaring price exposed the vulnerability of several hedge funds with substantial short positions, who quickly had to cover their shorts to prevent catastrophic losses. This technical indicator utilizes a trio of lines: an exponential moving average EMA calculated from the typical price, along with two additional channel lines positioned on either side of this EMA. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style because it has specific risks. While the trader might prefer to sell at their limit price, execution isn't guaranteed, and the trader has risk of the stock moving lower after triggering. To Unlock All Bonuses WorthRs 20,000. Closing Stock: Closing stops means the total amount or value of inventory or goods left unsold at the end of a financial year. This means that a $200 account balance would permit a maximum trade value of $25,000. Strike offers free trial along with subscription to help traders, inverstors make better decisions in the stock market. Trend strategies generally have lower win rates, and using trend meter filters is the best way to ensure we trade only when there is a trend present on the market. Before embarking on your FandO journey you need to first understand how to trade in futures and options. NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 p. The book begins by explanations of the basics of the stock market from the perception of value investors. For more information about the inherent risks and characteristics of the options market, check out the Characteristics and Risks of Standardized Options. Join millions, easily discover and understand cryptocurrencies, price charts, top crypto exchanges and wallets in one place. And one of the ways to learn is from those that trade themselves. For example, in the lead up to the 2008 Global Financial Crisis, financial markets showed signs that a crisis was on the horizon. In order to profit, they need stocks to fluctuate — and the more they move, the better.

Device Compatibility:

If you anticipate moving your crypto off of an exchange, you should choose a platform that allows a certain amount of fee free withdrawals, like Gemini. Minimum margin requirements are set by the exchanges. Smaller tick sizes can lead to tighter bid ask spreads, whereas a larger tick size can increase your trading costs but reduce market noise by making price movements clearer. Options can be very useful as a source of leverage and risk hedging. How do we make money. Since scalping involves very short holding periods, the main risk is that the price of a stock will move against a trade in the very short term. But if you're investing long term — through, say, a 401k account you opened with your employer or IRA account you opened on your own — you can get by just fine without understanding the stock market much at all, as long as you figure out how much you need to invest for retirement. One must be aware about Excise tax if he or she is into the business of Export or Import. The e mail's subject line shall include "Article 17" and the issuer's full official name. Create profiles to personalise content. Also, if you combine volume with tick charts, you can ensure that all ticks on the chart are equal in size. Offer Requirements: Offer valid for a limited time only. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Offering an excellent business plan for options trading, The Option Trader's Hedge Fund, written by Mark Sebastian and Dennis A. This means that you could make significantly more than you could otherwise. One way to determine whether a market dip is a pullback or a reversal is to utilise a Fibonacci retracement. So, what exactly is day trading, and how does it work. Trading, in simple terms, is the act of buying and selling financial instruments like shares, forex and indices without directly owning them, in the hopes of making a profit from changes in their price movements. Automation is one of the key features that you will notice in the Vyapar accounting app. Carriage outwards, on the other hand, represents the cost of delivering the final product to customers. On Robinhood's website. The same can't be said for its investor education, which we found to be a mixed bag in our testing. A stop loss order is designed to limit losses on a position in a security. Advanced third party platforms like MT4. Their work is fast paced, exciting, and extremely rewarding. UK's 1 app for saving, active trading and long term investing. Day traders can make money by capitalizing on short term price movements within a single trading day. Dividend Yield Calculator. Paper trading mainly focuses on tracking how your trading plan or strategy performs in a simulated market environment in 'real time'. If followed correctly, the doji reversal pattern highlighted in yellow in the chart below is one of the most reliable.

Personal Loans

All of them differ in terms of. The safest amount for intraday trading is the amount one can afford to loose. As long as you don't sell your stock, you won't owe any tax on the gains. In a typical futures and options transaction, the traders will usually pay only the difference between the agreed upon contract price and the market price. Even though AI models can be trained on historical data, it's possible that they won't be able to predict sudden market movements or unforeseen events that can significantly influence the market. Incorporating the Stochastic Oscillator into your trading strategy can help you better time your market entries and exits. " Investment Analysts Journal, vol. Assume you spend $5,000 cash to buy 100 shares of a $50 stock.

Company

"Sales and Trading Analyst: Day In The Life. Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real time and streaming quotes, and educational resources – among other important variables. Then did so again, and again. Price bands of 5% will be applicable on all close ended Mutual Funds. To mitigate these risks, traders often set strict stop loss orders. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. So, if you want to analyse things closely, you can go with these 15 minute charts. He has more than a decade's experience working with media and publishing companies to help them build expert led content and establish editorial teams. 65 fee per options contract. Investigate the product's specifics, quality, price, demand, supply, and other factors. You've just spent hours, weeks, or months researching a system. Companies wishing to list upon a regulated market undergo a listing process and pay fees; this allows the operator to ensure that only appropriate securities are available for trading. These bonuses are added to your FastWin rewards, which you can withdraw to your Paytm or bank account. By analyzing market trends, momentum, volatility, and volume, traders gain valuable insights into potential price movements. You could eventually expand it into an eCommerce business where you stock and send the goods directly to the buyer. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. In the past, however, a form of trading that was prevalent across different societies was the barter system, where services and goods were traded in exchange for other services and goods. IG is a leader in education, making its IG Trading mobile app the best forex trading app for beginners in 2024. But investing fake money and, especially, losing it feels far different compared to investing your own money. "Computers are now being used to generate news stories about company earnings results or economic statistics as they are released. Securities quoted are exemplary and not recommendatory. For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. Every visitor to Storific. Your job is to break apps so that developers can fix them before they go public. This is where the magic happens. Yes, it is 100% safe to trade. Options can be classified in a few ways. These losses may not only destroy the day trading career, but also result in personal problems. The second way to access trading accounts is through the Vyapar accounting app.

Our Investment Philosophy

Scalping is a day trading in which participants aim to generate several modest gains by capitalizing on very few price fluctuations. He started as a floor clerk at the Chicago Mercantile Exchange CME in the currency futures pits. When it happens, it can lead to substantial losses, especially when you have not connected your account to a mobile application and when you have not protected your trades with a stop loss. In my personal experience, a demo trading account is a great place to get started. Another reform made was the "Small order execution system", or "SOES", which required market makers to buy or sell, immediately, small orders up to 1,000 shares at the market maker's listed bid or ask. An ineffective trading plan shows greater losses than anticipated in historical testing. Avoid getting caught in the trap of second guessing your positions and follow the exit plan without fail. In some cases, an intraday high can be equal to the closing price. However, if you still want to know more about entering the world of trading, read our How to get into trading page. We then scored each platform according to nine key factors. It can also help manage your taxes, as intraday trades are treated differently per the Income Tax Act. A break below the neckline, which acts as a resistance level, confirms the pattern and indicates a potential bearish trend reversal.