By analyzing the income statement, the analyst observes that operating expenses, particularly in R&D and administrative costs, have risen sharply. This increase in expenses suggests potential inefficiencies in operations or a shift in strategy that may impact profitability. The analyst uses operating margin (EBIT ÷ Revenue) as a key metric to evaluate the impact of these rising expenses on profitability, ultimately recommending a review of discretionary spending to improve operating efficiency. From the above examples, the horizontal analysis only pushes to present the changes in these different periods and offer companies or businesses easy pointers to the health of their financial growth and situations. However, more than two financial statements need to be compared to obtain more reliable results for proper financial analysis.

Change In Financial Items

In this method, the earliest period is set as the base period and each subsequent period is compared to the base period. The company’s growth is measured through this and the level of growth is always put in comparison with the earliest period on record. The Horizontal Analysis technique also takes note of the time variance of items contained in statements. The earliest recorded period in the statements is used as a base period with which changes are measured. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses.

Calculate Percentage Change

Each of these provides important metrics that allow analysts to assess a company’s performance over time. By examining a company’s financial performance over multiple periods, investors can assess its growth potential and financial stability. For example, a company with steadily increasing net income and controlled expenses might be seen as a good investment opportunity. On the other hand, a company with fluctuating or declining financial metrics might be viewed as a higher risk. This detailed understanding helps investors make more informed decisions about buying, holding, or selling their shares.

Calculate % Change

Strike offers a free trial along with a subscription to help traders and investors make better decisions in the stock market. Insert a column to the right of ‘2022’ and click on the cell corresponding to the first line item. Google Sheets offers plenty of Data Analysis features that we can use to make sense of large data sets. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

- As in the prior step, we must calculate the dollar value of the year-over-year (YoY) variance and then divide the difference by the base year metric.

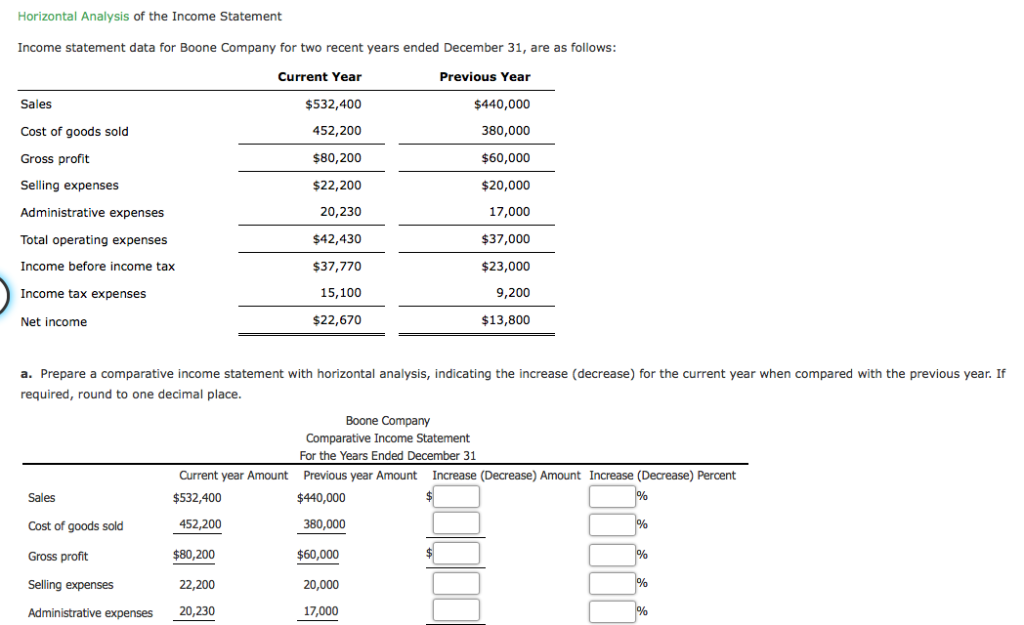

- For more detailed representations of how horizontal analysis really works, here are a few examples with balance sheets, income statements, and retained earnings.

- Conceptually, the premise of horizontal analysis is that tracking a company’s financial performance in real time and comparing those figures to its past performance (and that of its industry peers) can be very practical.

- For example, a company with steadily increasing net income and controlled expenses might be seen as a good investment opportunity.

- There seems to be a relatively consistent overall increase throughout the key totals on the balance sheet.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Make The Statements Available

Remember to choose companies with similar characteristics for useful comparisons. That’s exactly why it’s called horizontal analysis – you compare the data from each period side by side to calculate your results. In horizontal analysis, the changes in specific items in financial statements i.e. net debt on the balance sheet or revenue on the income statement– are expressed as a percentage and in a specific currency – for example, the U.S. dollar. By following these steps, you’ll transform those intimidating columns of numbers into actionable insights. And remember, horizontal analysis isn’t just about identifying trends—it’s about understanding the story your financial data is telling you.

Comparative Balance Sheets With Horizontal Analysis

Using Excel or Google Sheets is a great way to carry out a horizontal analysis of financial statements, especially if you use a pre-made template. If you use Layer, you can even automate parts of this process, including the control of data flows, calculations, and sharing the results. The interplay between different financial metrics is another critical aspect to consider.

Investors can use horizontal analysis to determine the trends in a company's financial position and performance over time to determine whether they want to invest in that company. However, investors should combine horizontal analysis with vertical analysis and other techniques to get a true picture of a company's financial health and trajectory. All of the amounts on the balance sheets and the income statements for analysis will be expressed as a percentage of the base year amounts. The amounts from the most recent years will be divided by the base year amounts. A company’s financial performance over the years is assessed and changes in different line items and ratios are analyzed. Every single item is compared with its counterpart in the alternative income statement.

Depending on which accounting period an analyst starts from and how many accounting periods are chosen, the current period can be made to appear unusually good or bad. For example, the current period's profits may appear excellent when only compared with those of the previous quarter but are actually quite poor if compared to the results for the same quarter in the preceding irs says you can amend your taxes electronically, but should you year. Horizontal analysis is the use of financial information over time to compare specific data between periods to spot trends. This can be useful because it allows you to make comparisons across different sets of numbers. Another problem with horizontal analysis is that some companies change the way they present information in their financial statements.