When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. While that might please those stakeholders, there is a counterargument that some businesses may be better off deploying that cash elsewhere, with an eye toward growth. Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing. You may check out our A/P best practices article to learn how you can efficiently manage payables and stay fairly liquid. With this data at your fingertips, cross-departmental collaboration becomes more productive, allowing you to identify opportunities to improve efficiency and AP turnover to help the business grow.

- Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well.

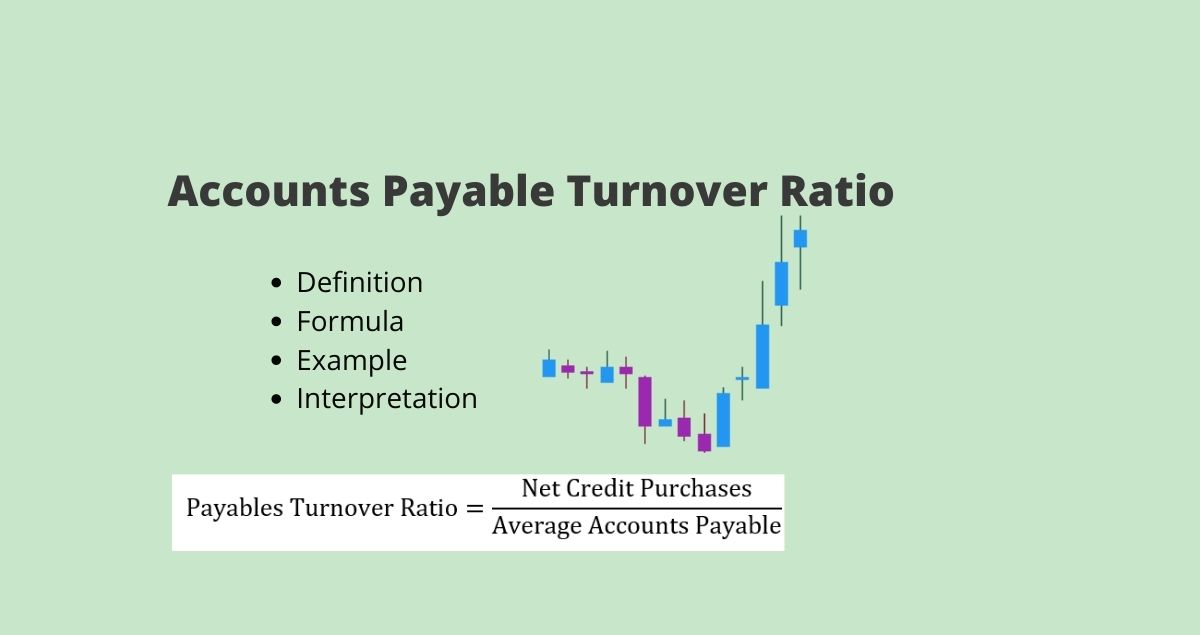

- So, while the accounts receivable turnover ratio shows how quickly a company gets paid by its customers, the accounts payable turnover ratio shows how quickly the company pays its suppliers.

- To see how attractive you will be to funders, match your AP ratio to peers in your industry.

- During the current year Bob purchased $1,000,000 worth of construction materials from his vendors.

- A higher ratio suggests efficient liquidity management, whereas a lower ratio could indicate potential cash flow challenges needing further investigation.

Days Payable Outstanding (DPO): Formula, Calculation & Examples

As part of the normal course of business, companies are often provided short-term lines of credit from creditors, namely suppliers. Invoice processing, expense reporting, subscription payments, approval workflows, and even accounting integrations, all of these can be handled simultaneously by using Volopay. With Volopay you get a comprehensive consolidated dashboard that is capable of managing accounts payable process completely.

Do you want a high or low accounts payable turnover?

Your vendors might not be willing to continue to extend credit unless you raise your accounts payable turnover ratio and decrease your average days to pay. Using those assumptions, we can calculate the accounts payable turnover by dividing the Year 1 supplier purchases amount by the average accounts payable balance. Investors can use the accounts payable turnover ratio to determine if a company has enough cash or revenue to meet its short-term obligations. Creditors can use the ratio to measure whether to extend a line of credit to the company. Suppliers are more likely to offer favorable terms and discounts to companies that consistently pay on time, which can positively impact the AP turnover ratio.

Switch to an automated AP solution

But as indicated earlier, a high turnover ratio isn’t always what it appears to be, so it shouldn’t be used as the sole marker for short-term liquidity. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Now that you know how to calculate your A/P turnover ratio, you can try to improve it by following our tips below. When getting the beginning and ending balances, set first the desired accounting period for analysis. For example, get the beginning- and end-of-month A/P balances if you want to get the A/P turnover for a single month. Our list of the best small business accounting software can help you find the solution that fits your needs.

How To Decrease AP Turnover Ratio

Accounts payable turnover ratio is important because it measures your liquidity and can show the creditworthiness of the company. The accounts payable (AP) turnover ratio gives you valuable insight into the financial condition of your company. It is used to assess the effectiveness of your AP process and can alert you to changes needed in your financial management. The formula can be modified to exclude cash payments to suppliers, since the numerator should include only purchases on credit from suppliers. However, the amount of up-front cash payments to suppliers is normally so small that this modification is not necessary. The cash payment exclusion may be necessary if a company has been so late in paying suppliers that they now require cash in advance payments.

Accounts payable turnover is a ratio that measures the speed with which a company pays its suppliers. If the turnover ratio declines from one period to the next, this indicates that the company is paying its suppliers more slowly, and may be an indicator of worsening financial condition. A change in the turnover ratio can also indicate altered payment terms with suppliers, though this rarely has more than a slight impact on the ratio. If a company is paying its suppliers very quickly, it may mean that the suppliers are demanding fast payment terms, or that the company is taking advantage of early payment discounts. When the figure for the AP turnover ratio increases, the company is paying off suppliers at a faster rate than in previous periods. It means the company has plenty of cash available to pay off its short-term debts in a timely manner.

A high ratio indicates that a company is managing its creditors effectively and is more likely to have access to credit and financing on favorable terms. Additionally, it is important to note that the Accounts Payable Turnover Ratio should not be analyzed in isolation. It should be considered alongside other financial ratios and metrics to gain a comprehensive understanding of a company’s financial health. Therefore, it is essential to analyze multiple financial ratios and metrics to make informed decisions about a company’s financial health. Like all key performance indicators, you must ensure you are comparing apples to apples before deciding whether your accounts payable turnover ratio is good or indicates trouble. If you decide to compare your accounts payable turnover ratio to that of other businesses, make sure those businesses are in your industry and are using the same standards of calculation you are.

Supplier relationships are integral to the accounts payable processes of your business. Effectively managing them can get you deals, offers, and discounts on accounts payables which in materials and supplies inventory definition turn can help improve your AP turnover ratio. A company with a low ratio for AP turnover may be in financial distress, having trouble paying bills and other short-term debts on time.

DPO counts the average number of days it takes a company to pay off its outstanding supplier invoices for purchases made on credit. The total supplier purchase amount should ideally only consist of credit purchases, but the gross purchases from suppliers can be used if the full payment details are not readily available. In addition, before making an investment decision, the investor should review other financial ratios as well to get a more comprehensive picture of the company's financial health. Paying bills on time faster will give you a higher AP turnover ratio which in turn will help you get better loans and lines of credit. Having full transparency into your company’s spending behavior can give you great insights into the areas where accounts payable turnover can be improved. The Days payable outstanding should relate reasonably to average credit payment terms stated in the number of days until the payment is due and any early payment discount rate offered.

Automated AP systems can streamline invoice processing, reduce errors, and provide real-time visibility into payment status. The AP turnover ratio can differ widely across industries due to varying business models and payment practices. Therefore, comparing a company’s ratio with industry averages or benchmarks is crucial for accurate interpretation.