LIFO is not practiced much outside of the United States because it can create an artificial tax advantage that's generally frowned upon in other countries. By valuing products based on the most recent cost, companies anything that can go wrong will go wrong can reduce their incomes on paper since there's always a stream of new products being purchased or produced. Despite increasing production costs, Company A retains a consistent sales price of $400 per vacuum.

- FreshBooks accounting software offers a helpful way to manage business inventory, track new orders, and organize expenses.

- Making sure that COGS includes all inventory costs means you are maximizing your deductions and minimizing your business tax bill.

- Our editorial team independently evaluates products based on thousands of hours of research.

- For example, businesses with a beginning inventory of perishable goods will usually choose FIFO, since it’s in their best interest to sell older products before they expire.

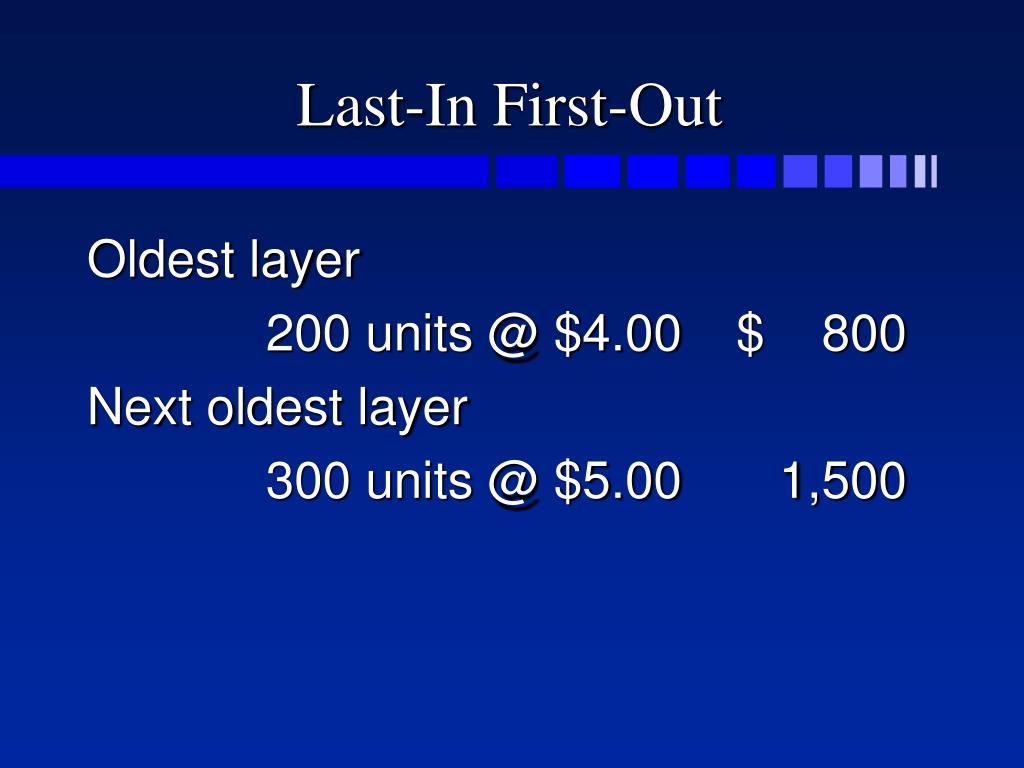

- The cost of the remaining 1200 units from the first batch is $4 each for a total of $4,800.

Why You Can Trust Finance Strategists

That is, it is used primarily by businesses that must maintain large and costly inventories, and it is useful only when inflation is rapidly pushing up their costs. It allows them to record lower taxable income at times when higher prices are putting stress on their operations. Due to economic fluctuations and the risk that the cost of producing goods will rise over time, businesses using FIFO are considered more profitable – at least on paper.

Which Is Easier, LIFO or FIFO?

For example, suppose a shop sells one of the two identical pairs of shoes in its inventory. One pair cost $5 and was purchased in January, and the second pair was purchased in February and cost $6 unit. In the tables below, we use the inventory of a fictitious beverage producer called ABC Bottling Company to see how the valuation methods can affect the outcome of a company’s financial analysis. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products.

LIFO Lowers Tax Bills During Inflation

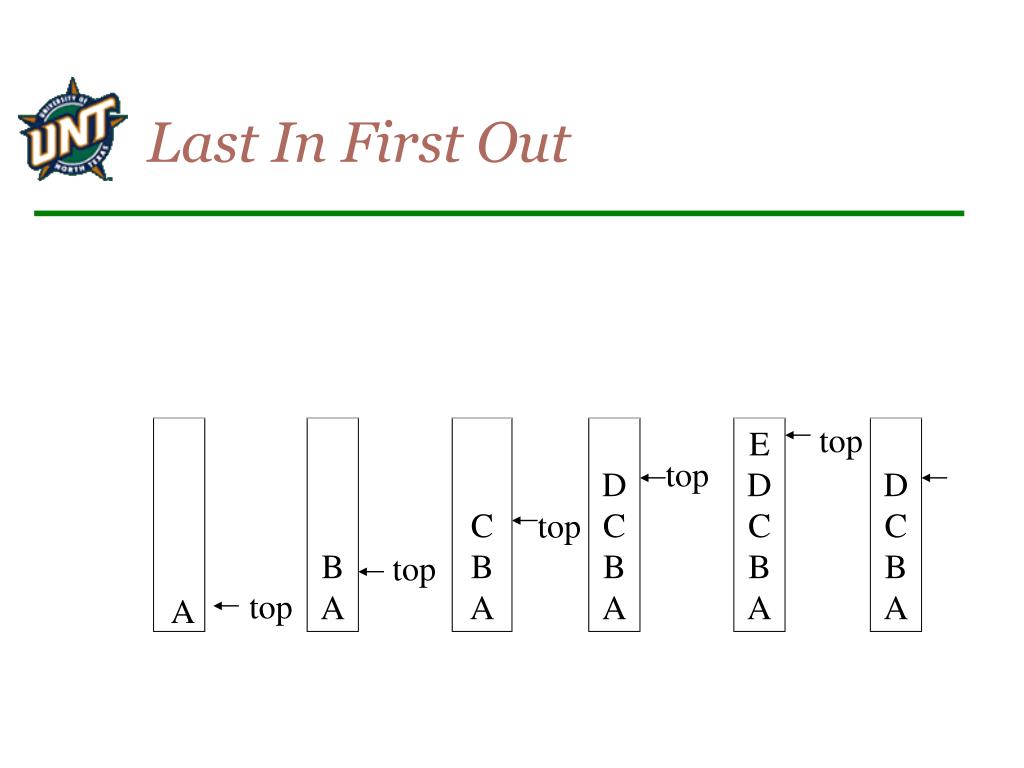

Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Under LIFO, Company A sells the $240 vacuums first, followed by the $220 vacuums then the $200 vacuums. Let’s break down the process involved in arriving at the above value of ending inventory. Last In First Out (LIFO) is the assumption that the most recent inventory received by a business is issued first to its customers. LIFO is best suited for situations in which inventory needs to remain up-to-date and turnover is high, such as in retail stores or warehouses. It is not recommended for situations where stock needs to remain consistent or bulk discounts are available.

Logistically, that grocery store is more likely to try to sell slightly older bananas as opposed to the most recently delivered. Should the company sell the most recent perishable good it receives, the oldest inventory items will likely go bad. The average cost method produces results that fall somewhere between FIFO and LIFO. The valuation method that a company uses can vary across different industries. Below are some of the differences between LIFO and FIFO when considering the valuation of inventory and its impact on COGS and profits.

Let’s say on January 1st of the new year, Lee wants to calculate the cost of goods sold in the previous year. FIFO inventory costing is the default method; if you want to use LIFO, you must elect it. Also, once you adopt the LIFO method, you can't go back to FIFO unless you get approval to change from the IRS.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website.

It is worth remembering that under LIFO, the latest purchases will be included in the cost of goods sold. The result of this decline was an increase in earnings and tax payments over what they would have been on a FIFO basis. By switching to LIFO, they reduced their taxable income and their tax payments.